Material supply strained

Global raw material problems challenge BVS Purchasing

Plants of car manufacturers such as BMW, Opel or Mercedes stand or stood still. The construction industry complains about extreme price increases for wood. According to a survey by the ifo Institute, 77.4% of industrial companies in Germany reported bottlenecks in the procurement of intermediate products and raw materials in September. Our purchasing department is also far from “normal operation”. Postponements, alternative requests and price adjustments are on the agenda.

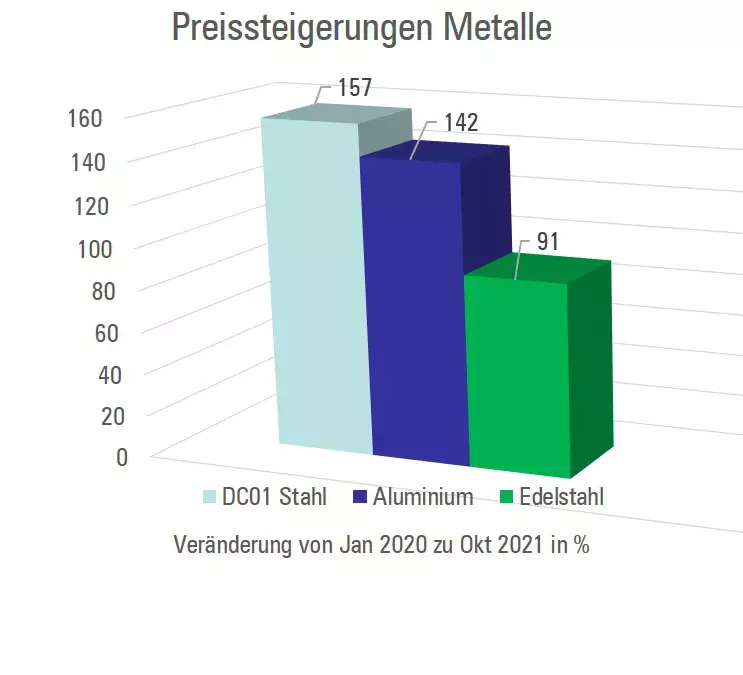

Price spiral for metals increases

The price increases for the metals most processed by BVS are considerable. “The price of steel has increased by 157% since the beginning of 2020, the price of aluminum by 142%, and aluminum-zinc is practically no longer available at all,” explains Harald Steiner, managing director at BVS Blechtechnik. “Raw material often has to be accepted on an ad-hoc basis, when it is just available from the supplier and then in bulk quantities,” Harald Steiner continues. This means in part high stocks of individual materials, for example we currently have 30 t of one metal in stock. Whereas other stocks cannot be replenished. We often receive cancellations from suppliers only one or two days before the promised delivery date. Inventories at the service companies are virtually empty; these are dependent on manufacturers and plants. According to a recent report, European rolling mills are not expected to ease in the 1st half of 2022.

Silicon price shock worsens aluminum production

According to the latest information, German and European aluminum plants are considering cutting back or even stopping production of aluminum. This in turn is due to a price shock for silicon, which is used as a plasticizer for aluminum alloys. Due to energy problems in China, the production of silicon there has almost come to a standstill. For BVS, this means that aluminum will be even less readily available in the near future and the price spiral will continue to rise. Due to these circumstances, volume contracts with our suppliers are currently not possible. Conversely, this means that we are unfortunately only able to provide our customers with limited information regarding prices and delivery conditions.

Shortage of material also for preliminary products and standard articles

In the case of short-term demand, the situation is particularly delicate and behind a successful order lies a great deal of effort. However, due to rescheduling of orders, short-term changes in parts, materials or articles have to be dealt with time and again. Required electronic parts for complete end devices cause us particular difficulties. The global chip crisis for semiconductors is resulting in very long delivery times. Also standard articles, connection technology, fans or powder material are not or hardly available. For example, deadlines of eight to nine weeks have to be accepted for packaging materials or cardboard packaging. A certain stock and timely reordering are indispensable for standard items. The organizational workload in our purchasing department has increased many times over, because alternative inquiries, postponements and price adjustments in the system have to be handled in a continuous loop.

Container prices from China explode

Getting raw materials and materials from overseas is quite expensive. Due to port closures in China and bottlenecks on supply routes, prices for containers from China have risen six to seven times. At the beginning of 2020, a standard container from China to Böblingen cost around €2,500; currently (October 2021), it costs around €17,000.

Many factors are causing a real storm in the procurement market as a result of the pandemic, including increased demand for a broad mass of raw materials, strained transportation routes and scarce production resources around the globe. Our purchasing team continues to exhaust all available options and channels, drawing on decades of relationships with suppliers to maintain production schedules and deliver ordered housings and assemblies to our customers.